The standard advice given to personal investors is to “diversify.” Spreading wealth across a variety of assets reduces the harm negative shocks can inflict on the overall portfolio. Global supply chains work the same way. Diversified supply chains are safer and more resistant to disruption.

For the US, its main concern is reliance on China. It supplies almost 20% of US healthcare imports and more than 30% of information technology imports. This over-dependence on a strategic rival fuels America’s current efforts to de-risk, including investments to reshore critical production.

The risk is particularly glaring in mineral imports, where China is not just a leading producer of raw materials, but also a hub of processing and distribution. But data show that the US consumes more from China than it needs to. There are alternative suppliers of minerals with which the US could be doing more business. Deepening partnerships with these other countries will help diversify America’s imports and will bolster supply chain resilience.

A diversification problem

Critical dependencies aren’t just about how much a country imports. They’re about whether supply chains are diverse enough to limit exposure to costly disruptions.

Minerals illustrate the point. Minerals accounted for only 2.5% of America’s critical goods imports in 2023, lagging big-ticket items such as pharmaceuticals (18%) and communication technologies (34%).[i] Yet that relatively small amount of trade is vitally important to making things such as medicines, semiconductors, and many other goods on which the US would prefer to be less dependent on foreign suppliers.

The problem is that minerals imports are far less diversified than other critical goods.[ii] The US gets most of its critical minerals from just a few countries—and that small list includes China.

There are 44 minerals for the America is heavily “import-dependent” according to the US Geological Survey.[iii] That means the US gets at least 50% of its total supply of those minerals from abroad. China is a top-3 supplier of 26 of those 44 minerals. Several of those are minerals that the US gets a full 100% of its supply from abroad, including graphite, arsenic, and mica. Each of these has important applications in a variety of sectors.

The “over-consumption gap”

One reason minerals imports are less diversified is simply that not every country has rich endowments of natural resources. Minerals aren’t like shoes or car parts, which can be made just about anywhere. But even when taking natural endowments into account, the US buys more from China than it needs to.

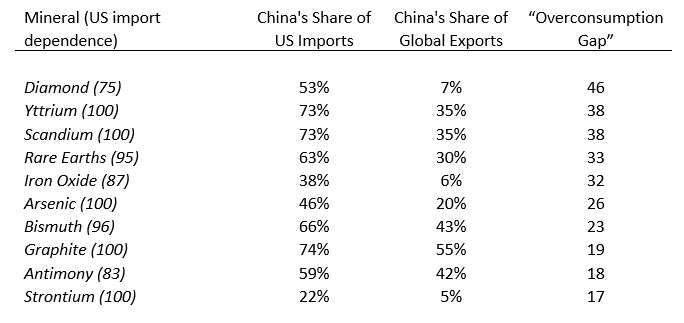

Table 1 reports the gap between China’s share of US imports and its share of global exports. In each case, there’s at least a 17-point difference between the two shares. That distance—the “overconsumption gap”—suggests there are other potential suppliers in the global marketplace that the US may be underutilizing.

There are alternative markets with which the US could do more business in each of the 10 minerals listed in Table 1. For example, India exports 9 of them, Malaysia 7, South Africa 6, and Brazil 4. But right now, the US gets only 5% of its supply from those countries, whereas 55% comes from China.

And smaller markets offer promise as well. Consider graphite, which is used in batteries, lubricants, and nuclear power. The US gets all of its graphite from abroad, and 74% of that is from China. But Mozambique and Madagascar are also major exporters, accounting for a combined 17% of global exports. Today, the US gets just 8% of its graphite from those two countries. Doubling imports from those two countries would cut graphite consumption from China by 12%.

Moving forward

How can these dependencies be addressed? The US could reduce its dependence on China simply by purchasing more from those other suppliers, but this is not easily done. It requires investment. There’s a reason why China has become a hub for much of the world’s mineral processing and distribution—its active engagement abroad. China’s aggressive approach to investment has seen Beijing dedicate enormous capital to mineral rights, extractive infrastructure, and refining capacity around the world.

Given the stiff competition for critical minerals, the US needs to make similar commitments abroad. There are already a variety of MOUs with African and Asian partners. The next step is to make meaningful investments in infrastructure in these countries to bolster production capacity in raw materials and eventually in intermediate goods processing. At the same time, the US must incentivize partners to do business with America by offering tangible market access. This means rebooting trade deals to lock strategic partners into cooperative arrangements in critical sectors. The net result will be greater diversification—and less risk.

[i] All numbers come from author’s analysis of data on 2023 trade data from the US Census Bureau’s USA Trade Online as well as statistics from the World Bank’s World Integrated Trade Solution.

[ii] A Herfindahl Index—a traditional measure of dispersion—shows that minerals imports are far more concentrated (0.12) than all other critical goods imports (0.07).

[iii] Import dependence is measured as the share of aggregate demand accounted for by imports. See U.S. Geological Survey, 2023, Mineral commodity summaries 2023: U.S. Geological Survey, https://doi.org/10.3133/mcs2023.

Authors

Associate Professor in the School of Government and Public Policy and the James E. Rogers College of Law, University of Arizona

Wahba Institute for Strategic Competition

The Wahba Institute for Strategic Competition works to shape conversations and inspire meaningful action to strengthen technology, trade, infrastructure, and energy as part of American economic and global leadership that benefits the nation and the world. Read more