The original version of this article appeared on Foreign Policy.

It’s not often that a change in accounting rules could reduce the probability of war. But that’s exactly what happened at the U.S. Securities and Exchange Commission (SEC) last month.

On August 22, the SEC finally enacted long-overdue regulations requiring any oil company that is publicly listed on a U.S. stock exchange to report the tax, royalty, and other payments it shells out to foreign governments where it operates. Previously, companies were able to conceal this information, enabling a culture of corrupt payoffs that kept the petrodollars flowing into authoritarian leaders’ coffers – even where it directly contravened U.S. interests.

Making this kind of financial information available to the public is an important step toward reducing corruption and increasing political accountability in developing countries where oil is extracted. This, in turn, will improve development prospects and counteract authoritarian tendencies, potentially even reducing rates of civil conflict. High rates of corruption in oil-producing states like Angola and Nigeria, for instance, have stymied development and contributed to human rights abuses – some of which oil companies were directly responsible for. In Nigeria, for instance, Royal Dutch Shell is accused of complicity in dozens of murders and human rights abuses, the details of which have been laid bare in a U.S. Supreme Court case this year.

In Angola, both sides of the bloody civil war that lasted from 1975 to 2002 were financed by natural resource wealth: one by oil, the other by diamonds. The oil industry played a pivotal role in that war, generating critical funding for the eventual victors, the People’s Movement for the Liberation of Angola (MPLA), as well as grievances that inspired separatist groups in the oil-rich Cabinda region to fight for independence from the rest of the country. The presence of oil companies also generated additional incentives for South Africa, Cuba, and the Soviet Union to intervene, as each stood to gain preferential access to Angola’s oil in the event that its side won (though oil was not their only motive).

But the SEC ruling is not just beneficial to developing countries – it is also in the interests of the United States and its allies. If oil money is not managed well – and it rarely is – it can get channeled into civil and interstate conflicts that threaten the United States or its interests. Research shows that oil-producing states led by revolutionary governments like that of ousted Libyan leader Muammar al-Qaddafi are more than three times as likely to instigate militarized international conflicts as a typical state. Oil income makes these petrostates aggressive, emboldening them to pick fights they might not otherwise attempt – think Iraq’s 1991 invasion of Kuwait or Libya’s armed conflicts with Chad that lasted over two decades. And with 16 developing countries about to become new oil exporters, the likelihood of petro-fueled conflict is only getting higher.

Among those that have recently uncovered oil reserves are Liberia, Mali, Sierra Leone, and Uganda – all of which were recently entangled in civil or interstate war, or both. Providing these governments with oil income – especially without transparent financial procedures and political institutions – is an invitation to disaster.

Predictably, the U.S. oil industry opposed the SEC ruling. Executives at Exxon and Shell have come out against the rule change on the grounds that it could contravene local laws in oil-producing countries. Yet it’s not even clear that laws forbidding the disclosure of such payments exist. Of the four countries (Angola, Cameroon, Qatar, and China) identified by the industry as having such laws, three clearly do not prohibit disclosure, and there is no evidence of a legal prohibition in the fourth (China). Brazilian oil giant Petrobras, which operates in 30 countries (including Angola) and will fall under the new rules because it is listed on a U.S. stock exchange, has said it was not aware of any country with a curb on official disclosure.

The oil lobby has so far stuck to its guns, insisting that in addition to respecting local laws, it must also safeguard sensitive commercial information. The head of the American Petroleum Institute, for example, argued in The Wall Street Journal: “The danger arises if publicly traded energy firms are required to release – for public consumption – commercially sensitive, detailed payment information about every foreign project.” But the law makes no such requirements; the royalty rate or commercial terms of a project, for instance, do not need to be released. Only the type and total amount of payments made for each project and to each government need to be reported. A more likely explanation for the oil industry’s opposition is its desire to remain insulated from public scrutiny and criticism.

No one should be fooled by Big Oil’s reaction to the SEC decision. Whatever small burden it is forced to bear will be more than outweighed by reduced corruption in oil-producing states and ultimately, reduced chances of war. The SEC ought to be congratulated.

Jeff Colgan is a Wilson Center fellow, assistant professor of International Relations at American University, and author of the forthcoming book Petro-Agression: When Oil Causes War.

Sources: Colgan (2010), EarthRights International, NPR, The New York Times, Publish What You Pay, Reuters, Ross (2012), SCOTUS Blog, U.S. Securities and Exchange Commission, The Wall Street Journal.

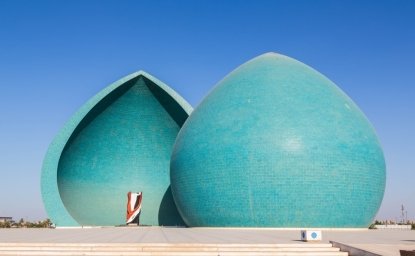

Photo Credit: West Africa’s first oil well, drilled by Shell in 1956, courtesy of flickr user ✈Rhys✈ (Rhys Thom).