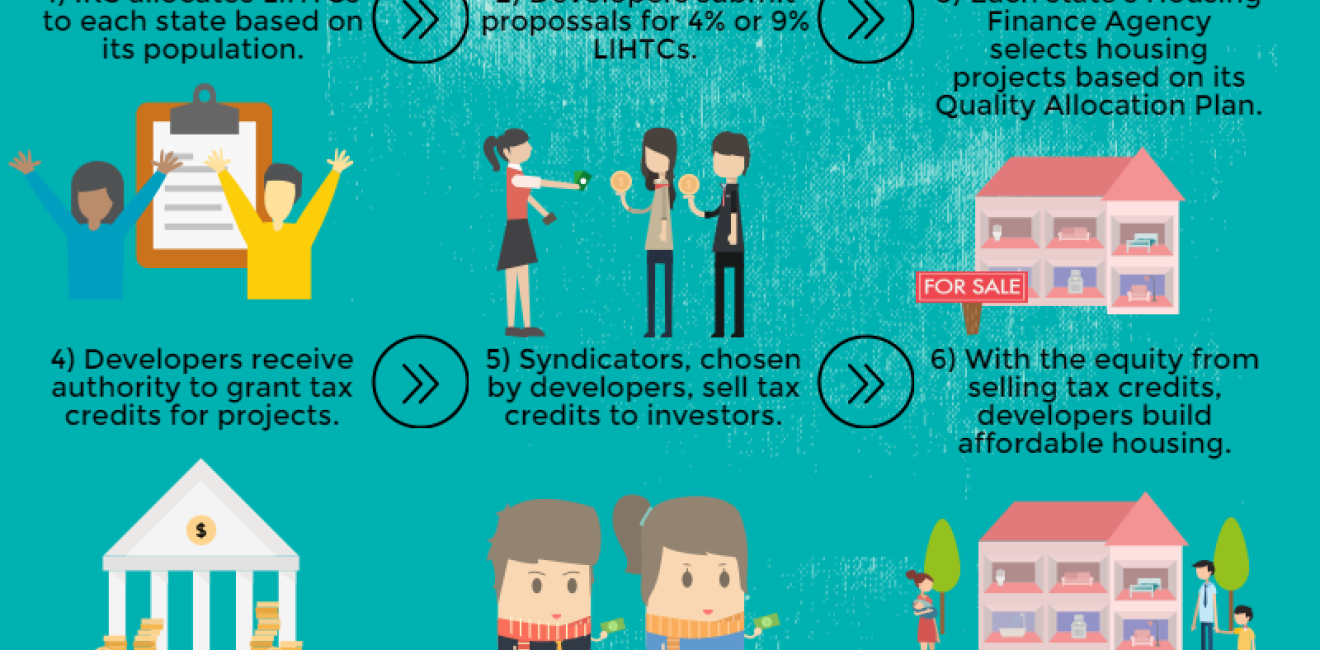

The Low Income Housing Tax Credit Program (LIHTC) is an indirect subsidy mechanism created in 1986 to promote affordable housing construction. The Internal Revenue Service and state housing finance agencies work together to create incentives for nonprofits and for-profit developers to build affordable housing by attracting investors for tax credit benefits. With equity from sale of the tax credits, developers are able to build affordable housing. LIHTC properties provide units for low-income renters at affordable rents.

Loading...

(function(d){var js, id="pikto-embed-js", ref=d.getElementsByTagName("script")[0];if (d.getElementById(id)) { return;}js=d.createElement("script"); js.id=id; js.async=true;js.src="https://magic.piktochart.com/assets/embedding/embed.js";ref.parentNode.insertBefore(js, ref);}(document));

Author

Urban Sustainability Laboratory

Since 1991, the Urban Sustainability Laboratory has advanced solutions to urban challenges—such as poverty, exclusion, insecurity, and environmental degradation—by promoting evidence-based research to support sustainable, equitable and peaceful cities. Read more

Explore More

Browse Insights & Analysis

Apprenticeships Are an Overlooked Path to Upward Mobility

Planning for Resilience In and After Conflict—A World Away