Narrator: Welcome to Blockchain Explained, the podcast about opportunities, challenges, and trends in blockchain technology. Whether you're a beginner or an expert, a developer or just crypto-curious, this podcast is for you. It features industry leaders and government officials discussing the world of distributed ledgers, cryptocurrencies, and the metaverse. And now, here are your hosts, Alan Rechtschaffen and Kellee Wicker.

Kellee Wicker: Welcome to a new year of Blockchain Explained, the podcast where we give you education and cutting-edge news on what's new in blockchain. I'm your host, Kellee Wicker, the director of the Science and Technology Innovation Program here at the Wilson Center, and I'm joined by my co-host, Alan Rechtschaffen, who chairs our Digital Assets Forum and is also a trustee of the Wilson Center. Alan, good to see you again.

Alan Rechtschaffen: Great to see you. Welcome back for the new year. I'm very excited to kick off the year with Michael.

Kellee Wicker: Yeah. So today we're joined by Michael Greenwald, who's Amazon's global lead for digital assets and financial innovation. Super excited. We're going to talk about a lot of interesting things, including everyone's favorite buzzword, AI, and how it intersects with blockchain, but also talk a little bit about some of the efficiencies we're seeing start getting built into the chain. And really, I think I'd like to start there. How are we seeing, you know, transactions per second speed up and start to equal what we see in traditional finance?

Michael B. Greenwald: Sure, Kellee, Alan, thanks so much for having me. Great to be here with the Wilson Center. Um, I think, really, as we go into 2024, we're at a digital asset inflection point, and that illustrates that there's a growing demand from businesses, consumers, governments to reduce their reliance on a single currency or an economy really to promote economic stability. And so, when you think about that, resulting from this moment, you know, in my view, is that in the years ahead, this will evolve a basket of currencies approach in global finance. And that includes important interactions to your question between stable coins, CBDCs, cryptocurrencies, fiat currencies. And so, when you think about, you know, Kellee and Alan, the economic landscape today, it's evolving rapidly with this emergence, of various fiat currencies, CBDCs, and cryptocurrencies. And what's interesting is that each of them represent goals or priorities set forth by that issuing body. And so, what this really denotes is a diversified world economy where many types of the currencies, decentralized and state-issued, live alongside each other. So I think just giving that backdrop of where we are as we go into the new year.

Alan Rechtschaffen: And when you talk about, or when you tell your background in our paths across a number of different areas, you've served in government. You've served in academics. Now you're at Amazon. I'm curious, when you talk about the idea of central bank digital currencies, and this idea of a digital version of a fiat currency. Is that a cryptocurrency as it was perceived of in 2008, when the white paper was written by Satoshi Nakamoto, or is it something different, which doesn't require this broad decentralization?

Michael B. Greenwald: So, I think what we've seen since that period of time is exploration. A lot of experimentation in these pilot programs, you know, 95 percent GDP of countries, 130 plus countries have been exploring this idea of a central bank digital currency, many at different stages. But I mean, at the heart of this, Alan, to your question, is that governments have sped up their exploration of CBDCs to really increase efficiency, decrease transaction costs, and speed up settlement times. Those are the three objectives in response to this rise in decentralized finance. And so, the continued and future operation of CBDCs, but also stable coin networks, you know, that's going to be integral to the financial system of tomorrow because of the peg of the dollar. And that also requires the expansion, you know, in our world at AWS about resilient, secure, cloud-based infrastructures. Now that's at the heart of what we're discussing. And then, regardless of whether the architecture, Alan, is centralized in a CBDC, or based on a digital, a distributed ledger template. So that's really, the heart of the financial landscape conversation that we're seeing.

Alan Rechtschaffen: And companies like Amazon, like Amazon is in a unique place, right? Because everybody does business with Amazon. That may be true. I mean, you'll have to tell me one day if that's true, what percentage of the world is actually doing business with Amazon, but, is there any talk of a corporate CBDC, like the idea that corporations would start to have their own digital currency in the way that a sovereign might.

Michael B. Greenwald: You know, so we, we take a very agnostic view of the space because, like you said, we have customers, in the decentralized finance space like in Avalanche, which we've partnered with, or companies like Circle and Paxos or, you know, major central banks. And so, it gives us a very unique perspective of that financial landscape. And I think what I've observed, which has been fascinating, is that the financial landscape has been in this constant state of evolution, of reimagination. And so, think about it – from, you know, stock ticker machines to algorithmic trading systems, you know, innovation, Alan, has been at the core of finance in this evolution. And so, among these transformative changes, what is really at the heart of what we're seeing now is this convergence, you know, Kellee, to what we've discussed about. Artificial intelligence in digital assets, CBDCs, tokenized assets, which will be a major theme for 2024. And really, I think has the potential to be most disruptive change to finance in decades. And so, it's that convergence of AI and digital assets I see at the heart of the future of finance.

Kellee Wicker: I'd love to hear a little bit more about when you talk about the convergence of those two technologies, what is AI empowering us to do in blockchain that was previously difficult or maybe not even feasible?

Michael B. Greenwald: Sure. So, when you think about the convergence of AI and digital assets, the convergence of these two emerging technologies, right? They're still emerging. Even though it's early days. So, AI, I think about it, with its ability to self-learn. And extract, you know, actionable insights, you know, from vast amounts of data and digital assets, which exist on a decentralized, transparent, you know, automated network. That's expected to further amplify the impact of one another. And that's why the convergence is so exciting. And so just to think about this, there's like a few ways to think about combining the strengths of both technologies that can develop a more efficient and robust financial system, which I think consumers and customers as we're talking to them, they're really attracted to. So in order for AI to be effective, Kellee, to your question, it's a trusted source of data. It needs to be accessible and on demand. You know, digital assets, which, you know, blockchain technology, they allow financial transaction data to be stored in a trusted, accessible and transparent fashion. Now, I can access that data such as transaction history, which is very helpful and current balances for that real time financial analysis. And so, there are really, when you look at what we're doing at Amazon, Amazon managed blockchain, that query, you know, system where AI trading algorithms can use that and something we called AMV access, which, you know, swaps digital assets with new rules, you know, are met. And so those are a couple ways to think about the beginning of that convergence.

Alan Rechtschaffen: Can you give us an example of a specific project? I mean, I don't want you to reveal anything behind the curtain. I mean, I do, but you probably won't. But I would love to hear about a specific project. Look, we understand we spent a year in our first year of blockchain explaining, explaining the blockchain. And I think our, our, our viewership as our listeners now understand what the blockchain is. We've seen some use cases, but I'd love to hear some innovative idea that you've seen or that you're contemplating or that you're doing, of implementing this technology with the convergence of the financial aspects of it and perhaps the artificial intelligence aspects as well.

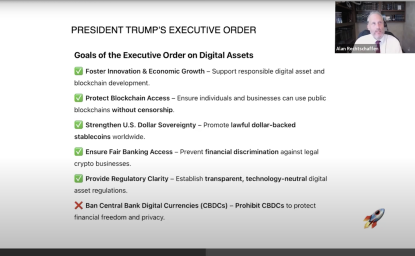

Michael B. Greenwald: Sure. Listen, the Wilson Center has been such at the heart of this conversation and you really, champion this conversation through this thought leadership, which I, I find so valuable to the space, you know, Alan, you and I have talked about how I view this space like the Renaissance, right? We all have to line up our easels and learn from each other and look over each other's shoulders, so I'm always looking over my shoulder and seeing what you're working on. What I would say to give you an example is take, for instance, AI tools that analyze Ethereum smart contracts. That could track the impact of traditional off-chain market prices, such as equity markets, to, you know, on-chain lending platform activities, such as liquidations or platform withdrawals, you know, and based on these complex relationships, the AI could generate new signals, right, to remove liquidity from lending platforms when equity markets, decrease a certain percent. So that's just one example of that convergence, and that new levels of efficiency. You know, I think, also, when we look at our tools, and these are tools that we're seeing, you know, being adopted, technologies like Amazon Code Whisperer, they're speeding up coding tasks, right? So they're providing, you know, in line code suggestions, to improve a developer productivity, and that's positive for this new era of responsible innovation that we've seen be highlighted by the new executive order coming out of the White House. So, in addition, you know, Amazon Code Whisperer, one of my favorite names, really, you know, it can detect, you know, hard-to-find security vulnerabilities. It can flag emerging security vulnerabilities during development. So, this is where it helps the documentation for smart contracts, for example.

Kellee Wicker: I'm really interested, just kind of going back to, one of your earlier comments on the basket of currencies, this view of all of these currencies coexisting, which I think those of us who love blockchain, that's, that's the goal. But I think, sometimes, and Ellen, you've talked about this a little bit, sometimes there is, there seems like a view in traditional finance that this is going to somehow replace traditional finance. I would love to hear a little bit more about your view of how do these things coexist? What are the gaps that we're filling with digital currencies, that are going to kind of augment the whole system?

Michael B. Greenwald: So, I think when you, again, when you look at the economic landscape, it's evolving rapidly with the emergence of, you know, centralized and decentralized. And really, it's a discussion with the customer, you know, domestically and globally, want optionality, wants choices. And that's where that basket approach occurs. So whether it's, you know, the grandmother or grandfather or the parent or the kids or the grandkids, each of them are going to have different goals in mind. And that's where the optionality takes place. Now, recent developments, you know, such as economic sanctions, they've ignited, you know, certain isolationist sentiment across the world. And that's led to a fracturing of interest, you know, values, leadership, and that's where, Kellee, it creates an economy that's based on a basket of currencies rather than one that hinges primarily on the performance of the US dollar, even though we're seeing so much peg to the dollar. So I think that what we're seeing is this like paradigm shift in financial infrastructure, and that's where the convergence of AI and digital assets is so exciting. And so it's, it's mutually reinforcing, really to democratize, you know, financial automation, increased efficiency, and then significantly ramp up, security protocols. And so, when you think about it, this economic landscape, you know, going into the new year and the years ahead, it's a future where AI is processing both on chain and off chain data, which is going to require a new infrastructure to cohesively function. And that's why the Infrastructure Resilient Cloud Based Network is so important and is at the heart of this conversation.

Alan Rechtschaffen: And is, is Amazon's commercial interest in this to be the hubs of this, to provide the servers, to handle the nodes of whatever network, decides to build out these things?

Michael B. Greenwald: So what, what I, what I, what's so enjoyable, about this role and, you know, being at AWS. is the ability to work with, you know, like I mentioned, customers across the centralized and decentralized space. And so, we, approach each of these, you know, trying to listen, not only to these, you know, innovative companies, but then what's the reaction to folks in the, you know, future of payments and how that's, playing a role. So, I think that the more data these generative AI tools have access to, the more effectively they will spot errors or security risks, which, you know, is a key priority. And then that will just make it more proactive for identifying, mitigating those risks, to the financial sector because we want there to be a transparence in the financial sector as possible. And that's at the heart of this. At the same time, you know, Alan, and you asked about you know, blockchain networks, you know, in which, you know, these digital assets, you know, they exist to provide that transparency, right? That single source of truth and that provenance, which will help, you know, validate the authenticity of the information being actioned on, you know, by AI. And so, I think that is so important is the trusted data. And so, I think although there are, of course, challenges ahead when you're in this new, innovative environment that need to be solved. I think, you know, innovators, and the customers and the companies that we're working with, you know, they're armed with these, you know, powerful cloud-based technologies, really to unlock these benefits of AI. And that's where we see, the benefits being unlocked converging with digital assets.

Alan Rechtschaffen: And Michael, as this all is evolving and as these new use cases are happening, is Bitcoin sort of in its own world? Is it sort of just doing its own thing as being the storehouse of value and like the first and, and now becoming much more mainstream? And by the time this podcast airs, maybe we'll know what's going on with a potential Bitcoin ETF. That's not a promotion of a Bitcoin ETF or any investment advice whatsoever. But just the idea that this technology in the form of Bitcoin has become much more mainstream as becoming much more of a storehouse of value where you saw in 2023, how much Bitcoin skyrocketed from the beginning of 2023 till the end. And I'm just wondering, is Bitcoin sort of living in its own world while all this other stuff is going on with blockchain technology?

Michael B. Greenwald: Well, I mean, I think that what we've been focused on is the blockchain technology. And what we've been focusing on is the infrastructure. Obviously, we keep abreast of the decentralized space, and the centralized space. I think what is going to be important to look for, Alan, is when the digital asset executive order talks about responsible innovation and when the AI, you know, executive order talks about responsible innovation, I think it will be interesting to see what does that look like in practice, in the decentralized financial space? What does that look like? If there is, you know, regulation or their guardrails moving forward, but we're more focused on, the infrastructure, how cloud-based technologies can be resilient and really underpin each aspect of the financial sector.

Kellee Wicker: We're coming up on our time here, so I want to leave us with a final thought. Michael, in 2024, what's going to be, maybe the key development that you're looking forward to seeing or maybe a key pilot project that's somewhere in the world that you're watching?

Michael B. Greenwald: I think, I'm looking for, again, how this convergence between A.I. and digital assets will be further implemented across the board as more experimentation takes place. I think, also, you're seeing a lot of white papers about tokenization in the use cases that are coming out regarding that. So, I'm looking forward to see how that looks. And then, as I mentioned at top, there's growing demand from businesses and consumers about reducing their reliance on just one single currency. I'm interested on what that means for stable coins as it's pegged to the dollar. What does that pie look like in the future economic landscape? Those are a couple of things that I will be interested, but, you know, I want to thank you and the Wilson Center for just, all the work you're doing, because it's important to have these conversations, and it's important to bring the different stakeholders you bring together to be educated, because these things are moving very fast, and I know that we all appreciate the great work you do.

Kellee Wicker: Well, thank you so much, Michael, for your time. This has been really illuminating, and I personally have learned some stuff about what's on the cusp right now. And we hope that we'll see you again. And for those of you watching, we look forward to a great year of Blockchain Explained episodes. Stay in touch.

Michael B. Greenwald: Thank you so much, Kellee

Alan Rechtschaffen: Thank you, Michael.

Michael B. Greenwald: My pleasure.

Narrator: Thanks for listening to another episode of Blockchain Explained. Please note, nothing in this podcast should be construed as investment advice. Want a more clear-eyed analysis of this exciting technology? Search for Digital Assets Forum at the Wilson Center for research, event recordings, and more. Want to ask our host a question? Write to STIP, S-T-I-P, at www.wilsoncenter.org with your thoughts. Thanks again, and we'll see you next time on Blockchain Explained.