The 1989 movie, Field of Dreams, popularised the phrase, “If you build it, they will come.” When it comes to activating more private investment in sustainable infrastructure in developing markets, the opposite is true – if you come (closer to the norms private industry finds attractive), they will help you build it.

We must manage infrastructure debt in these economies, address how they are disproportionately affected by climate change, and scale up innovative financing mechanisms that can help increase investment levels. Yet developing nations must not lose sight of how the fundamental act of improving the enabling environment ensures that not only can they attract more private investment, but also enable those investments to deliver the best possible outcomes and return, thereby encouraging even more investment. Many nations and multilateral organizations stand ready to help advance this progress.

Global Infrastructure Hub’s (GI Hub) InfraCompass is a tool to help pinpoint where such efforts would be most productive. It quantifies the strength of the infrastructure enabling environment by country across eight key metrics: governance, regulatory frameworks, permits, planning, procurement, activity, funding capacity, and financial markets. By identifying each country’s top-performing metrics, as well as those with the most room for improvement, governments can develop informed policies to facilitate greater public and private infrastructure investment.

In this article, we discuss how developing economies can reform their enabling environment systematically by making incremental changes to de-risk the country overall (rather than on an individual project basis) to realize a greater overall effect without necessarily having to make large-scale reforms that carry high political and financial costs.

Why de-risk countries?

While de-risking by making changes at the project level may seem like the easier path, the more powerful interventions that support private investment in infrastructure are those that de-risk entire countries. Making changes at a country level may be harder, more costly, and sometimes unpopular. However the longer-term benefits have a far greater impact.

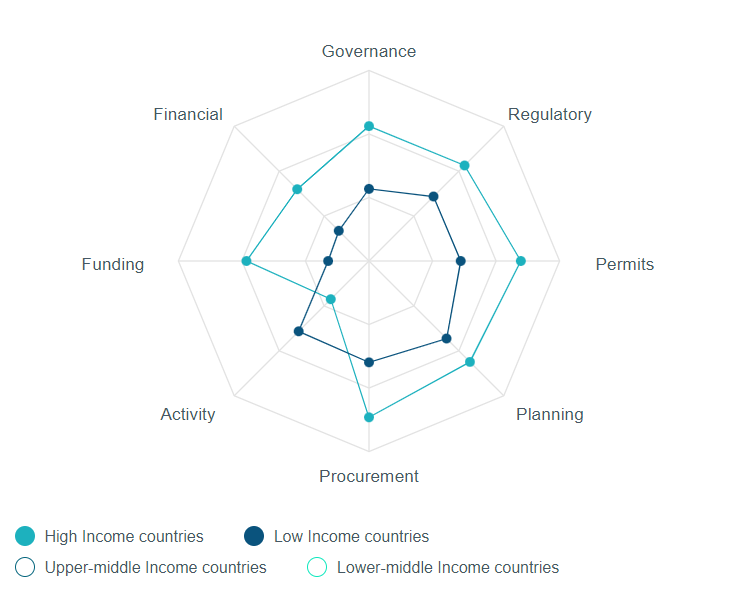

Typically, as countries achieve higher income levels, the funding gap recedes. The causal link is two-way. Countries improve their processes as they get richer, while better processes also lead to greater prosperity. This plays out when contrasting the InfraCompass collective results of high- and low- income countries, as displayed below.

Comparing InfraCompass metrics across high- and low-income countries

Perhaps the best way to close the gap in funding between high- and low- income countries is to consider key drivers of change:

- Governance

- Financial markets

- Procurement

- Permits.

The fact that these drivers are systematic does not mean problems are insoluble, nor that large-scale reforms with high political and financial costs are the only solution. Incrementalism is a proven formula specifically in infrastructure, and more broadly in public policy. Small, targeted changes can lead to vastly improved outcomes, and a few small reforms strung together can be greater than the sum of their parts. Noticeable improvements from such changes can help build political support for further moves in the direction of reforms.

Governance

A country’s recovery rate in the event of a failed project is a critical deciding factor on whether investors will consider opportunities in a jurisdiction. The recovery rate is calculated as cents on the dollar recovered by secured creditors through reorganization, insolvency, liquidation, or debt enforcement (foreclosure or receivership) proceedings.

India has significantly improved its recovery rate by making reforms to its insolvency proceedings. In 2019, the Insolvency and Bankruptcy Board of India (IBBI) amended the Insolvency and Bankruptcy Code Act to provide creditors of loan-defaulting companies with authority over the distribution of proceeds in the resolution process and clarity on order of priority for the distribution of liquidation assets. India’s recovery rate has improved from 26 cents per dollar in 2016 to almost 72 cents per dollar today, leading to the country’s 18-rank increase on governance measures in InfraCompass.

Financial markets

Strong financial markets can provide a variety of capital market instruments to encourage investors to finance infrastructure.

Through notable initiatives, Guinea has improved its financial markets. In 2019, the central bank, Banque Centrale de la République de Guinée, invited the IMF to conduct a Financial Sector Stability Review (FSSR). The FSSR found that return on equity increased by 2.6 percentage points between 2017 and 2018 (to 19.3%). Based on an analysis of IJ Global data, today there is little to no domestic equity involved in infrastructure projects.

While the evolution of local equity markets is often a slow process, investments through local equity markets in other sectors (such as real estate or private infrastructure) should be seen as the foundation for potential domestic equity investment in public infrastructure in the future.

Even when a country looks to be at an investable level, investors will still take time to build knowledge at a local level around the country’s regulatory and operating environment to ensure they are comfortable investing in that jurisdiction. Recent improvements by Guinea hold the promise for greater infrastructure support in the future.

In 2019, the Brazilian Government partnered with the GI Hub to conduct a needs assessment and design a program to attract private investment to the country’s transportation infrastructure. This study included a benchmarking study on foreign exchange risk mitigation.

The amount of investment Brazil required exceeded local capacity. However, foreign investors remained concerned over currency volatility. The GI Hub modelled 10 global economies and conducted a benchmarking exercise showing how others were using hedging instruments and mechanisms to address foreign exchange risk. By evaluating global approaches and innovations to determine their suitability, Brazil was able to introduce new risk mitigations to address concerns about currency volatility among foreign investors.

As a result of this initiative and the others delivered through its partnership with the GI Hub, Brazil has attracted greater private sector participation (over USD $44 billion to date). Further value will be realized through enhanced infrastructure capabilities and ongoing public and private sector dialogues.

Procurement

Procurement is another area where rapid improvements can be made, such as with open and transparent tender guidelines to increase bidder confidence. Nations that maintain a commitment to transparency and consistent PPP guidelines are more attractive to private investors.

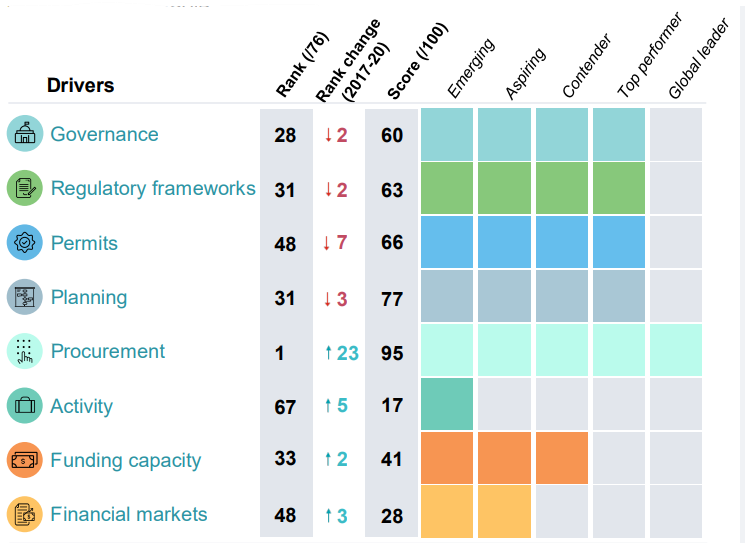

In InfraCompass, Mexico is the global leader for procurement, moving up 23 places after working with the OECD to digitize the country’s procurement processes for greater transparency and reform its guidelines for infrastructure and public-private partnership (PPP) projects.

Mexico’s overall performance on InfraCompass

Permits

Reducing delays in obtaining permits and approvals due to administrative or legal hurdles can improve the cost of doing business in developing economies.

By improving the process of transferring land titles and easing other administrative or legal hurdles, such projects immediately increase in appeal and attract a broader range of investors. This type of policy change can be relatively simple but can make a significant difference to foreign investors.

Following several reforms and changes, including the introduction of a digitized land transfer process, Rwanda significantly reduced the cost and time of doing business. InfraCompass now ranks Rwanda third globally (after Singapore and New Zealand) for efficiency of planning and licensing procedures for permits and acquisitions of land for development.

De-risking for long term benefits

To attract more private finance for infrastructure, emerging and developing economies must commit to creating an enabling environment and garner support from multilateral development banks to de-risk upstream, not just at the project level. Countries should also take advantage of the GI Hub and InfraCompass by addressing identified shortfalls in key driver areas relative to other countries. Policy makers identifying interventions and reforms to de-risk at the country level can spark greater private investment, unleashing long-term benefit for their citizens.

Authors

Chief Strategy Officer, Meridiam

Wahba Institute for Strategic Competition

The Wahba Institute for Strategic Competition works to shape conversations and inspire meaningful action to strengthen technology, trade, infrastructure, and energy as part of American economic and global leadership that benefits the nation and the world. Read more

Explore More

Browse Insights & Analysis

Why National Security Agencies Must Analyze Climate Risks

Climate Change, Grand Strategy, and International Order