This article analyzes the possibility that the Mexican government may not reach its revenue goal of 6,295,736.2 million pesos for this fiscal year (2021). The possibility arises because the Mexican government has estimated a 2021 level of income equivalent to last year's estimate (2020), adjusting only for inflation (3%) and without taking into account the 8% decline in economic activity due to the COVID-19 pandemic. Since Mexico’s 2021 growth rate is estimated to reach roughly 5% (according to latest projections) it seems likely that the government is over-estimating its collections. Secretary of the Treasury (Hacienda) Arturo Herrera has seemingly acknowledged this shortfall in his call for technical discussions to address government revenues, including through tax reform. Other policy options may include efforts to reduce tax evasion, further reductions in public spending, increased public debt, or a combination of all four instruments.

Framework

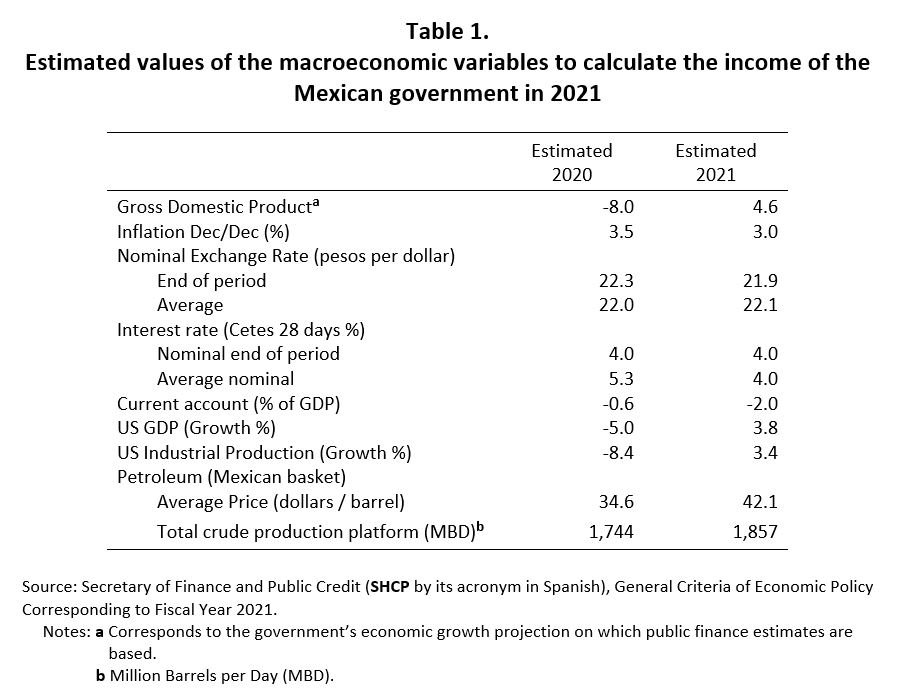

The Mexican government calculates its annual revenue based on a series of macroeconomic indicators (see table 1).

The values of these variables form the basis of the estimate of the Mexican government’s income and expenditure budget. If any one of these variables deviates greatly from its estimated value, the government would have to adjust its revenue estimate and probably its public spending plans.

Based on the values of these variables we analyzed Mexico's tax collection for this year (2021).

Analysis of the estimated tax revenues of the Mexican government, for fiscal year 2021

Background

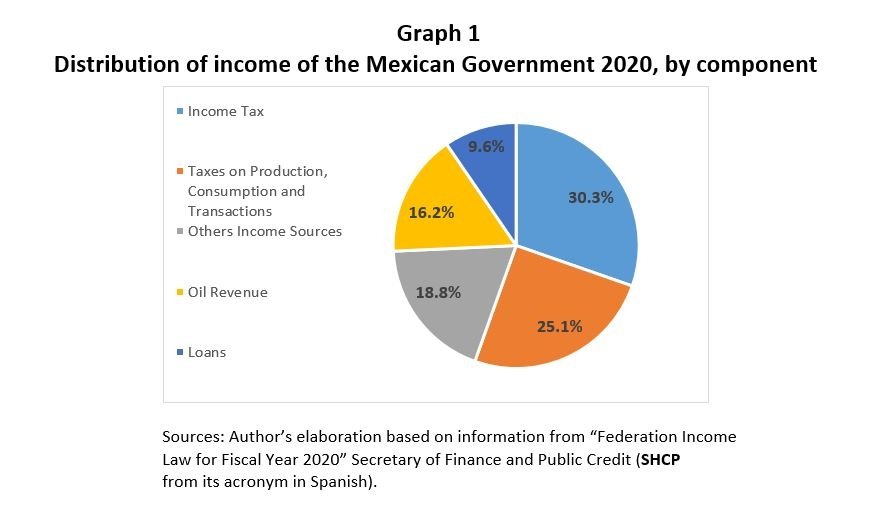

The Mexican government in 2020 estimated its Total Income would be 6,107,732.4 million pesos, with 30.3% derived from Income Tax (1,852,852.3), followed by 25.1% from Taxes on Production, Consumption and Transactions (1,534,055.8), 18.8% from Other Income Sources (1,149,034.8), 16.2% from Oil Revenue (987,332.7), and an additional 9.6% from loans (584,456.8) (See Graph 1).

Calculation of Mexican government revenue

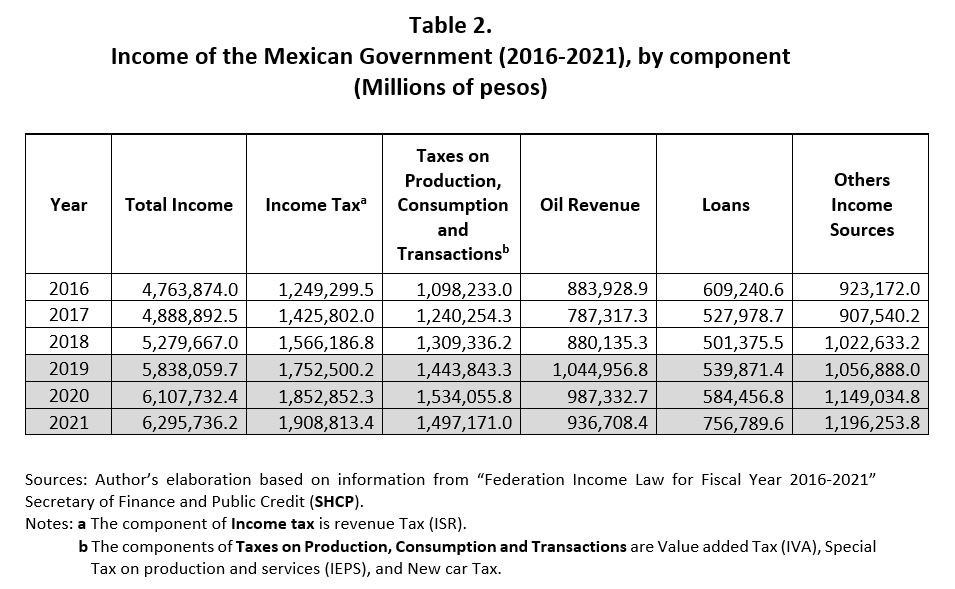

During the present year, the Mexican government calculates its Total Income at 6,295,736.2 million pesos (see table 2), 3.0% higher than last year. Therefore, the Mexican government estimates that its income in 2021 will be the same as last year’s estimate (2020), which is why it only added the inflation rate 3.0%.[1]

Total Income 2021 (6,295,736.20) = Inflation (1.0307) * Total Income 2020 (6,107,732.40)

Since social distancing and home confinement began in Mexico in April 2020, the effects of COVID-19 on the economy have been profound. According to SHCP, Mexico's Gross Domestic Product (GDP) fell -8.0% in 2020 (see table 1).

Doubt about the total amount of tax collection

The components of Total Income that are linked to revenue (Income Tax) and the production chain (Taxes on Production, Consumption and Transactions), which are the most affected by the COVID-19 health emergency, represented 55.4% of total government income in 2020 (see graph 1 above). Consequently, calculating the amount of 2021 tax collection based on the level of revenue in 2020 without taking into account the 8% fall in Mexico's GDP is optimistic to say the least. As a result, it is doubtful that the Mexican government will be able to achieve its tax collection goal for 2021.

The Mexican government would obtain a more credible estimate of its Total Income collection for 2021 if it were to simply recognize that the COVID-19 health emergency will affect the ability to collect taxes in 2021 and recalculates the collection linked to revenue and the production chain. That is, adjusting for the 8% drop in GDP in 2020 and the projected 5% growth in 2021 in the income, production, consumption and transaction tax components.

Conclusion

Due to the economic contraction of 8.0% in 2020 and the slow recovery of 5% for this year, it is difficult to believe that the Mexican government's tax collection for 2021 will reach the projected 6,295,736.2 million pesos. To achieve this collection goal, the Mexican economy would need to recover this year from last year’s decline.

Since projections suggest that a full recovery will not occur this year, the Mexican government will probably have to mitigate the loss in tax revenue this year by reducing tax evasion, reducing its public spending, increasing public debt, undertaking a tax reform, or a combination of these four instruments.

Without a doubt, the Mexican government has great challenges this year in fiscal matters.

[1] Note: The Mexican Congress approved the Federation Income Law for the Fiscal Year 2020 in November 2019 this the estimated total 2020 income (6,107,732.4 million pesos) did not contemplate the economic slowdown caused by the COVID-19 Public Health Emergency.

Author

Mexico Institute

The Mexico Institute seeks to improve understanding, communication, and cooperation between Mexico and the United States by promoting original research, encouraging public discussion, and proposing policy options for enhancing the bilateral relationship. A binational Advisory Board, chaired by Luis Téllez and Earl Anthony Wayne, oversees the work of the Mexico Institute. Read more

Explore More

Browse Insights & Analysis

360° View of How Southeast Asia Can Attract More FDI in Chips and AI