The Biden Administration shifted trade policy away from traditional trade deals to “framework agreements” that emphasize environmental sustainability and equitable growth. These are laudable goals, particularly as we consider creative ways to “green” the world’s economies and to address inequities in the labor force.

But while reforming many out-of-date trade rules is necessary, it is important to not overlook the benefits of formal treaties. Here are three underappreciated facts about the World Trade Organization (and other trade deals) that show the value of a rules-based system.

1. Trade deals promote stability

It doesn’t take a pandemic or a war to shock trade markets. Most shocks are caused by the introduction of unilateral trade barriers that disrupt the natural flow of goods and services among partner economies. New barriers create volatility by shocking prices, diverting trade, and encouraging retaliation.

Trade deals help stabilize markets because they lower the likelihood that member governments raise barriers against one another. And when trade barriers are erected, they are regulated by the agreement’s flexibility system. Flexibility provisions, such as anti-dumping and safeguards, limit the size and scope of the barriers. That means trade-distorting measures, when necessary, are created in a more controlled, transparent fashion. The result is less disruption to the market.

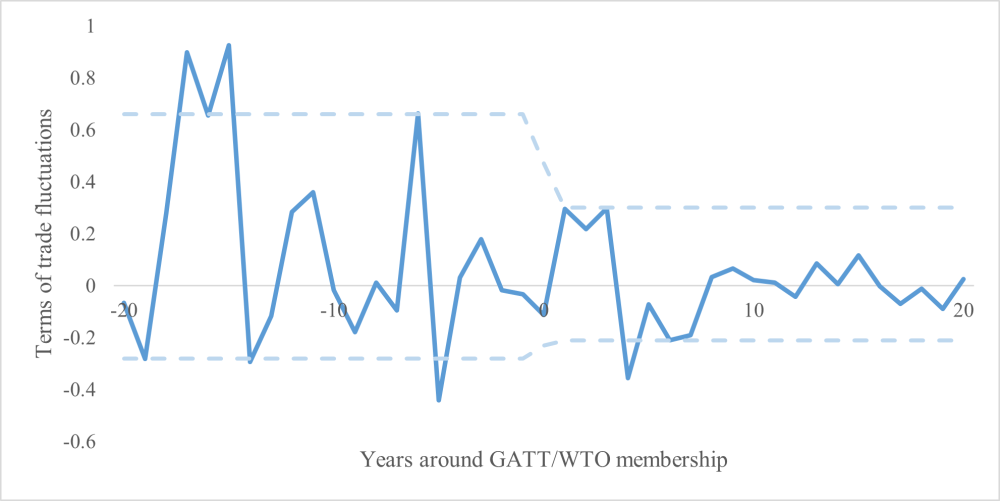

Terms of trade volatility – i.e., shocks to the relative prices of traded goods – is a particularly toxic form of instability that hurts governments, firms, and workers. Membership in the GATT/WTO system has had a clear, stabilizing effect. The average member saw its terms of trade volatility drop 45 percent in the 20 years after joining the system.

That reduction is important. When prices are unstable, trade-dependent countries cannot rely on steady gains from trade. It is no coincidence economists find that terms of trade volatility can stunt growth and development. By reducing volatility, a rules-based system does much more than promote trade – it makes trade safer.

Prices are twice as stable after joining the GATT/WTO

2. Countries generally follow the rules

Of course, a rules-based system only works if the players don’t cheat. In recent years, the main criticism facing the WTO (and other trade deals) is that some members do not honor their commitments. Despite some prominent exceptions, that criticism is not entirely accurate.

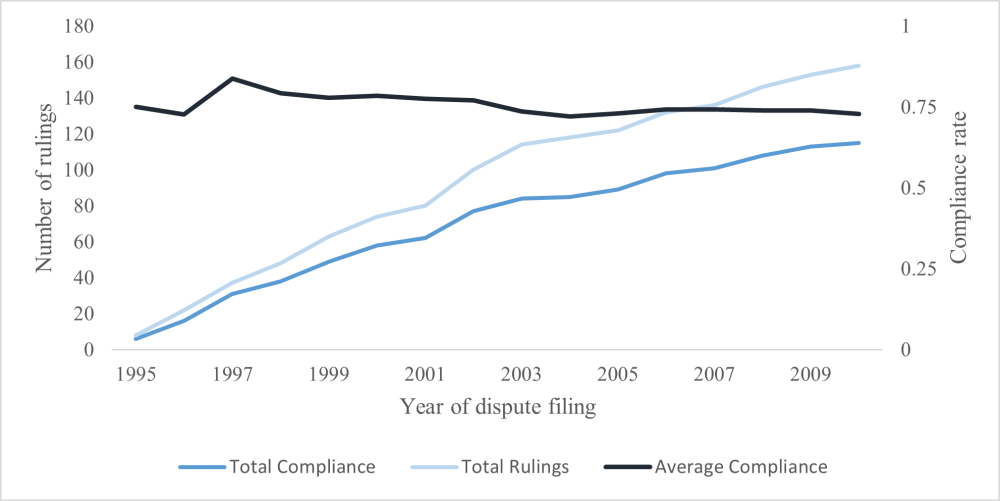

Compliance rates at the WTO are reasonably high, hovering around 72 percent through the first 400 disputes. That may seem like a low number by some standards. In domestic settings, something would be terribly wrong if we only obeyed theft or murder laws 72 percent of the time. But international law is different. There is no world police force and compliance is always voluntary.

That’s important in the context of trade because compliance can be costly. Governments must be willing to dismantle trade barriers that protect powerful industries when those policies are struck down in Geneva or elsewhere. Overcoming those domestic obstacles is not easy. So, when viewed in that light, compliance rates of 72 percent are not as bad as they may seem.

There are certainly exceptions. The elephant in the room is the US, whose willingness to comply, on average, fell precipitously after a key 2008 ruling on steel. Despite the frustrations of some key members, the system appears to work according to plan. In fact, that 72 percent may understate the dispute system’s effectiveness. The record looks even better if one counts the more than 100 disputes withdrawn or settled through private consultations.

Countries comply with WTO rulings over 70 percent of the time

3. Trade deals curb retaliation

Legal processes are not just about punishing violators, they also make sure the sentence fits the crime. That’s why countries often have domestic safeguards against cruel and unusual punishment.

Controlling punishment is particularly important in the context of trade. The whole point of formal dispute settlement is to avoid trade wars. The rules limit the extent to which a country may reply to another member’s discriminatory actions. At the WTO, countries have to request permission to retaliate against a respondent in the event of non-compliance. But it turns out this doesn’t often happen.

There have been 617 disputes as of July 1, 2023. Complainants have requested the right to retaliate against respondents on about 40 occasions, and only 9 disputes ended with retaliation authorized. That is a mere 1.5 percent of all cases.

As a result, formal dispute settlement takes trade relations out of an economic Wild West and places them in a system of relative law and order.

Moving forward

There are certainly caveats to the effectiveness of the rules-based system. Compliance rates used to be better than they are today, and there are widespread concerns that dispute settlement cannot reign in the behaviors of the largest markets. It’s also true that countries frequently accuse one another of abusing flexibility provisions, using the opportunity to escape as a substitute for traditional tariffs.

Those worries help explain why there is so little momentum in Washington to save the WTO. But at a time so rife with economic uncertainty, we should also not ignore the benefits rules can provide.

Author

Associate Professor in the School of Government and Public Policy and the James E. Rogers College of Law, University of Arizona

Wahba Institute for Strategic Competition

The Wahba Institute for Strategic Competition works to shape conversations and inspire meaningful action to strengthen technology, trade, infrastructure, and energy as part of American economic and global leadership that benefits the nation and the world. Read more

Explore More

Browse Insights & Analysis

US Inaction Is Ceding the Global Nuclear Market to China and Russia

Promoting Convergence in US-Brazil Relations