Where the Jobs Are

Europe is by far the most important source of “onshored” jobs in America, and the United States is by far the most important source of “onshored” jobs in Europe

Europe is by far the most important source of “onshored” jobs in America, and the United States is by far the most important source of “onshored” jobs in Europe

U.S. and European foreign affiliates are a major source of employment for the transatlantic workforce. On a global basis, affiliates of both U.S. and European parents employ more workers in the United States and Europe than in other places in the world.

U.S. foreign affiliate employment in Europe has increased steadily since the turn of the century, with affiliate employment in Europe rising from 3.7 million workers in 2000 to 4.8 million workers in 2018 – a 30% increase. We estimate that U.S. affiliates in Europe employed 4.9 million workers in 2019, a 1.6% increase from the year before.

While aggregate employment levels continue to rise modestly, manufacturing employment has plateaued since 2000. U.S affiliate manufacturing employment in Europe totaled 1.9 million in 2000, on par with the levels of 2018. However, while the overall number has stayed roughly the same, the country composition has changed, with more investment shifting to lower-cost locales like Poland and Hungary versus high-cost economies like the UK and France. The largest employment declines were reported in the UK, with the total manufacturing work force falling from 431,000 in 2000 to 293,000 in 2018. U.S. manufacturing employment in France dropped from 249,000 to 195,000. U.S. manufacturing employment in Germany has registered far less decline – from 388,000 in 2000 to 362,000 in 2018.

Poland continues to be a significant winner, with U.S. affiliate manufacturing employment growing more than 2.5 times, from 51,000 in 2000 to over 131,000 in 2018.

On a global basis, U.S. majority-owned affiliates (including banks and non-bank affiliates) employed 14.4 million workers in 2018, with about one-third of these workers living in Europe. Europe’s share of U.S. affiliate manufacturing employment is slightly larger at 34%, although this share is down from 40% in 2009. U.S. overseas capacity has been expanding at a faster pace in emerging markets than developed nations.

Another factor at work: more and more U.S. firms are opting to stay home due to competitive wage and energy costs, as opposed to shipping more capacity abroad. Indeed, the latest annual data on U.S. manufacturing employment indicates that American companies reshoring jobs to the U.S. in 2020 created more jobs than FDI for the first time in seven years. According to the Reshoring Initiative, the estimated number of manufacturing jobs created by greenfield investment was roughly 42,000, compared to 69,000 reshored jobs. Digital innovations also mean companies can now do some things from home that they used to do abroad. Additionally, the 2017 overhaul of the U.S. corporate tax code, which lowered America’s tax rate below the rates of many European countries, has spurred more investment to come home or stay in the United States.

Most employees of U.S. majority-owned firms in Europe work in the UK, Germany or France. These firms are, on balance, hiring more people in services activities than in manufacturing. The latter accounted for just 38% of total U.S. foreign affiliate employment in Europe in 2018. The key industry in terms of manufacturing employment was transportation equipment, with U.S. affiliates employing nearly 336,000 workers, followed by chemicals (283,000). Wholesale employment was among the largest sources of services-related employment, which includes employment in such activities as logistics, trade, insurance, and other related functions.

Although services employment among U.S. affiliates has grown at a faster pace than manufacturing employment over the past decade, U.S. affiliates employed more manufacturing workers in Europe in 2018 (1.9 million) than in 1990 (1.6 million). This reflects the EU enlargement process, which offered both U.S. and European companies greater access to more manufacturing workers, and the premium U.S. firms place on highly skilled manufacturing workers, with Europe one of the largest sources of such skilled talent in the world.

Combined, the transatlantic workforce directly employed by U.S. and European foreign affiliates in 2018 was roughly 9.7 million strong, up roughly 2% from the year before. Yet, affiliate employment growth in the United States in 2018 far outpaced growth of U.S. affiliates in Europe. In 2018, the latest year of available data, the U.S.-based workforce of European companies increased by 4.1%.

On the other side of the Atlantic, U.S. firms increased their European employment base by just 0.4%. This caused the employment balance to shift to favor the U.S. for the first time in 16 years – meaning that European companies now directly employ more Americans than U.S. companies employ Europeans.

Based on the latest figures, European majority-owned foreign affiliates directly employed 4.9 million U.S. workers in 2018 – some 194,000 more workers than in 2017. In 2018, the top five European employers in the United States were the UK (1.3 million, up 56,400 from 2017), Germany (860,700, up 44,900 from 2017), France (780,000, up 35,600 from 2017), the Netherlands (550,000, down 7,200 from 2017), and Switzerland (478,500, up 21,000 from 2017).

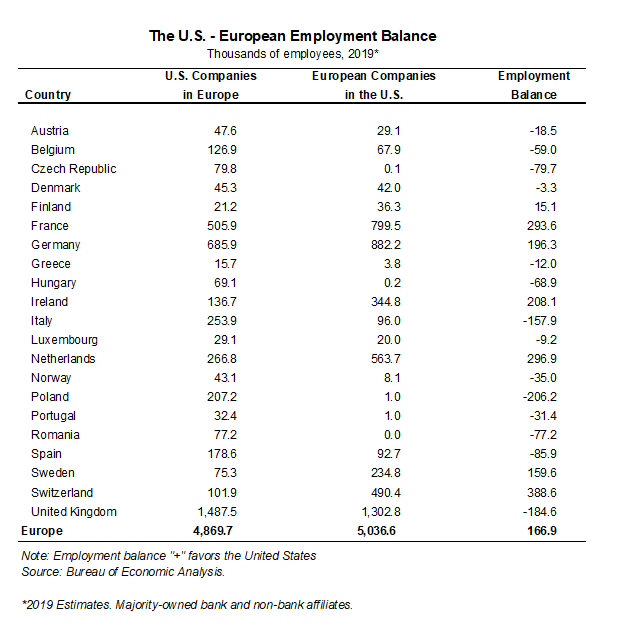

European firms employed roughly two-thirds of all U.S. workers on the payrolls of majority-owned foreign affiliates in 2018. In 2019, modest gains in employment were most likely achieved on both sides of the pond, with employment levels in the United States again rising at a faster pace than in Europe, according to estimates. For 2019 we estimate U.S. affiliates based in Europe directly employed about 4.9 million European workers, and European affiliates based in the United States directly employed about 5 million Americans. These figures understate the employment effects of mutual investment flows, since these numbers are limited to direct employment, and do not account for indirect employment effects on nonequity arrangements such as strategic alliances, joint ventures, and other deals. Moreover, foreign employment figures do not include jobs supported by transatlantic trade flows or local suppliers. Trade-related employment is sizable in many U.S. states and many European nations. Employment growth rates likely turned negative in 2020 as real growth and demand plummeted in the wake of the coronavirus recession.

Employment in Europe was relatively more resilient, due to more frequent use of subsidized furlough programs. Between March and December 2020, the U.S. unemployment rate averaged 9.0%, while in the EU the average was 7.3%. Despite the setback, direct and indirect employment remain quite large.

We estimate that the transatlantic workforce numbers some 14-16 million workers, counting both direct affiliate employees as well as those whose jobs are supported by transatlantic trade. Europe is by far the most important source of “onshored” jobs in America, and the United States is by far the most important source of “onshored” jobs in Europe.

The Global Europe Program is focused on Europe’s capabilities, and how it engages on critical global issues. We investigate European approaches to critical global issues. We examine Europe’s relations with Russia and Eurasia, China and the Indo-Pacific, the Middle East and Africa. Our initiatives include “Ukraine in Europe”—an examination of what it will take to make Ukraine’s European future a reality. But we also examine the role of NATO, the European Union and the OSCE, Europe’s energy security, transatlantic trade disputes, and challenges to democracy. The Global Europe Program’s staff, scholars-in-residence, and Global Fellows participate in seminars, policy study groups, and international conferences to provide analytical recommendations to policy makers and the media. Read more